How to Become a bookkeeper

Are you considering a career in accounting and finance? If so, becoming a bookkeeper might be the perfect first step for you. Bookkeeping is the foundation of accounting, and its demand has steadily increased as businesses grow and seek organized, efficient ways to manage their finances. In this article, we will cover everything you need to know about how to become a bookkeeper, from the qualifications required to the skills needed and the steps to launch your career. We’ll also touch on salary expectations, career progression, and how technology is shaping the bookkeeping profession.

What is a bookkeeper?

A bookkeeper is a financial professional responsible for managing a company’s day-to-day financial transactions. They record, classify, and reconcile financial data, ensuring that all accounts are accurate and up to date. While bookkeepers don’t usually prepare tax returns or perform audits (those tasks are usually handled by accountants), their work is crucial for the smooth operation of a business’s financial system.

Key Responsibilities of a Bookkeeper

Before diving into the specifics of how to become a bookkeeper, let’s first take a closer look at the key responsibilities you will have in this role:

- Recording Transactions: Bookkeepers record all financial transactions, including sales, purchases, payments, and receipts. They use specialized software to enter data into ledgers.

- Bank Reconciliation: They compare the company’s financial records with bank statements to ensure they match.

- Accounts Payable and Receivable: Bookkeepers track money owed to the company and payments due to vendors, ensuring that invoices are paid on time.

- Payroll Processing: In many cases, bookkeepers are responsible for ensuring employees are paid accurately and on time.

- Financial Reports: Bookkeepers help prepare financial reports, such as balance sheets and profit-and-loss statements, which provide insights into a company’s financial health.

Skills Required to Become a bookkeeper

Becoming a bookkeeper requires a combination of technical skills, attention to detail, and analytical thinking. Below are the most important skills you’ll need:

- Attention to Detail: Accuracy is critical in bookkeeping. Small mistakes can lead to larger financial issues.

- Organizational Skills: Bookkeepers must be able to organize and track large volumes of financial data.

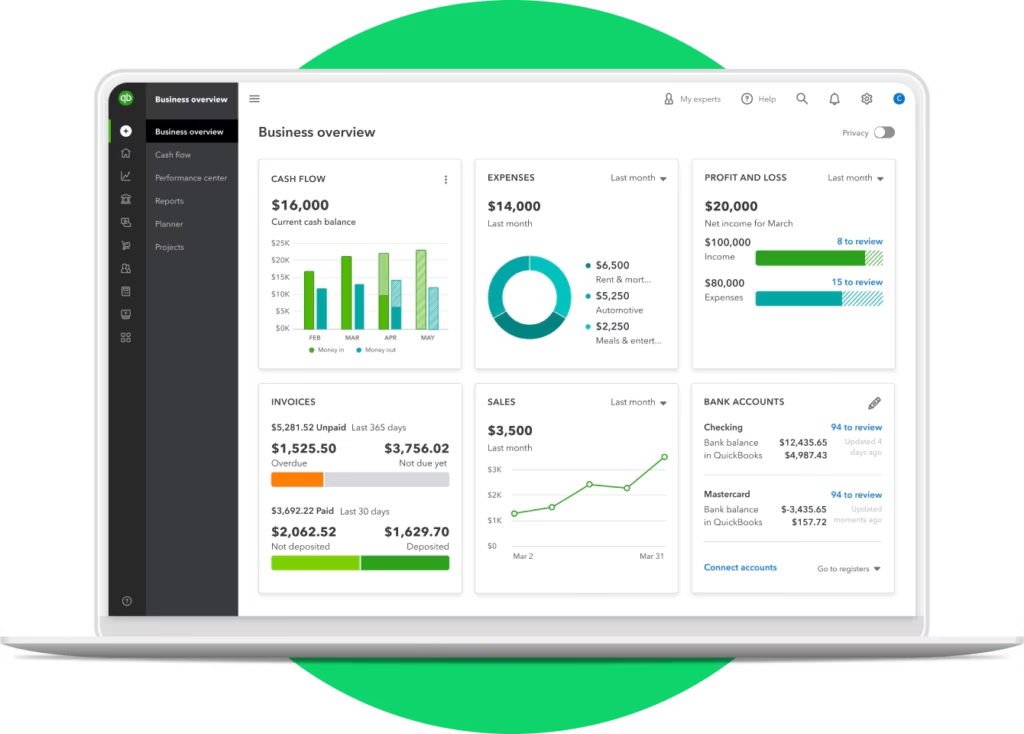

- Knowledge of Accounting Software: Familiarity with accounting software like QuickBooks, Xero, or FreshBooks is essential. Many businesses rely on these programs to manage their books.

- Mathematical Ability: Bookkeepers must be comfortable working with numbers and performing basic calculations.

- Communication Skills: Although bookkeepers typically work behind the scenes, good communication skills are important when interacting with clients, vendors, and other team members.

- Problem-Solving Skills: Bookkeepers often encounter discrepancies or issues in financial data that require investigation and resolution.

How to Become a Bookkeeper: A Step-by-Step Guide

Becoming a bookkeeper is a straightforward process, but it does require commitment and the development of certain skills. Below are the key steps you should take to pursue this career.

- Obtain the Necessary Education

While a formal college degree isn’t always required to become a bookkeeper, having a solid educational foundation will set you up for success. You can start by completing a high school diploma or GED, focusing on subjects like mathematics, business, and accounting.

If you wish to enhance your chances, consider pursuing an associate degree in accounting or bookkeeping. Many community colleges offer programs in accounting that cover subjects like financial accounting, payroll, taxation, and financial software.

- Gain Hands-On Experience

Once you’ve acquired the basic education, gaining hands-on experience is crucial. You can start by looking for entry-level positions like a junior bookkeeper or accounting assistant. These positions will provide you with the opportunity to work with more experienced bookkeepers and accountants, allowing you to develop your skills in real-world scenarios.

Many aspiring bookkeepers also gain experience by volunteering their services to small businesses or non-profits. This can provide valuable exposure while helping you build a portfolio of work.

- Learn Accounting Software.

Proficiency in accounting software is a must for bookkeepers. Many businesses now rely on digital tools to manage their finances, and being able to navigate these platforms will make you more competitive in the job market.

Some popular accounting software programs you should learn include:

- QuickBooks: One of the most commonly used accounting platforms for small businesses.

- Xero: A cloud-based accounting software that offers similar features to QuickBooks.

- FreshBooks: A user-friendly platform favored by freelancers and small businesses.

Consider enrolling in courses or certifications that teach these software tools, as they will make you more efficient and capable in your role.

- Consider Certification

While not always required, obtaining a bookkeeping certification can boost your credibility and career prospects. The American Institute of Professional Bookkeepers (AIPB) and the National Association of Certified Public Bookkeepers (NACPB) offer certification programs that assess your knowledge and skills in bookkeeping.

The certification process typically involves passing an exam and meeting certain experience requirements. Being a certified bookkeeper demonstrates your commitment to the profession and sets you apart from those who don’t have formal credentials.

- Look for Employment Opportunities

After gaining the necessary education, experience, and possibly certification, you can begin looking for bookkeeper jobs. Many businesses, including small businesses, accounting firms, and large corporations, need skilled bookkeepers. Some other common job titles to look for include accounting clerk, payroll specialist, or financial coordinator.

You can also consider working as a freelance bookkeeper, offering services to small businesses that may not have the resources for a full-time in-house accountant.

- Stay Updated with Industry Trends

The field of bookkeeping is constantly evolving, especially with the increasing use of automation and artificial intelligence in financial software. To stay competitive, it’s essential to keep up with the latest trends in accounting technology and best practices.

Joining industry groups, subscribing to relevant publications, and participating in online courses can help you stay informed and ensure your skills remain relevant.

How Much Do Bookkeepers Earn?

The earning potential for bookkeepers varies depending on experience, location, and industry. On average, a bookkeeper in the United States can earn between $40,000 and $55,000 annually. However, salaries may be higher in major cities or industries like finance and insurance.

Freelance bookkeepers have the potential to earn more, especially if they manage several clients at once. Your earnings will also be affected by the number of hours you work, your experience level, and whether you hold certifications.

Career Progression for Bookkeepers

Bookkeepers can enjoy a variety of career progression opportunities. Many start as entry-level bookkeepers and eventually move on to more senior positions. Some career paths you can consider include:

- Senior Bookkeeper: With additional experience, you can advance to a senior bookkeeper position where you may supervise other bookkeepers.

- Accounting Clerk: With further training, you can transition into a role that involves more complex financial tasks like tax preparation or auditing.

- Accountant: Many bookkeepers eventually pursue an accounting degree and become accountants. If you are interested in taking on more advanced responsibilities, this might be a great career move.

Final Thoughts

Becoming a bookkeeper can be a fulfilling and stable career choice. Whether you want to work for a company, manage your own clients, or eventually pursue further career opportunities in accounting, bookkeeping provides a solid foundation in financial management. With the right education, experience, and certification, you can enjoy a rewarding career helping businesses manage their finances efficiently.

As you embark on your journey to become a bookkeeper, remember that the role requires constant attention to detail, a solid understanding of accounting principles, and a commitment to staying up to date with the latest financial technologies. By following the steps outlined in this guide, you’ll be well on your way to a successful career in bookkeeping.